When moving your family to the UK, searching for a perfect home can be a headache. You’ve got enough on your plate, balancing work, the kids, and the mountain of packing boxes that seem to multiply overnight.

At the same time, finding the right place isn’t just about the number of bedrooms – it’s about the community, good schools, and a space where your family can thrive. That’s where mobile house-seeking apps step in. They’re like having a savvy mate who knows all the ins and outs of the housing market without bothering with endless phone calls and appointments.

These apps streamline the search, filter through the noise, and serve up potential homes that tick all your boxes. With all the other things you’re juggling, letting these apps take some of the strain can be a real lifesaver. We’ve gathered some of the best apps for you to review, so stick around to learn more about each one!

Top House-seeking Apps in the UK

There are close to 456,000 individual properties on sale in the UK at any given time. Going through even a tenth of them will take much time and effort. Thankfully, house-seeking apps have streamlined this process, making it much easier to sift through potential homes from the comfort of your sofa.

These apps provide a comprehensive view of the property market, allow you to filter search results to match your specific needs, and even send you notifications when something that ticks all your boxes pops up.

We used Rightmove and Zoopla with smart alerts to inform us of new homes in the desired area. I Don’t recommend using anything that looks a bit spammy/Facebook marketplace etc- go for trusted sources only!

That said, here’s more on the best UK property apps currently available:

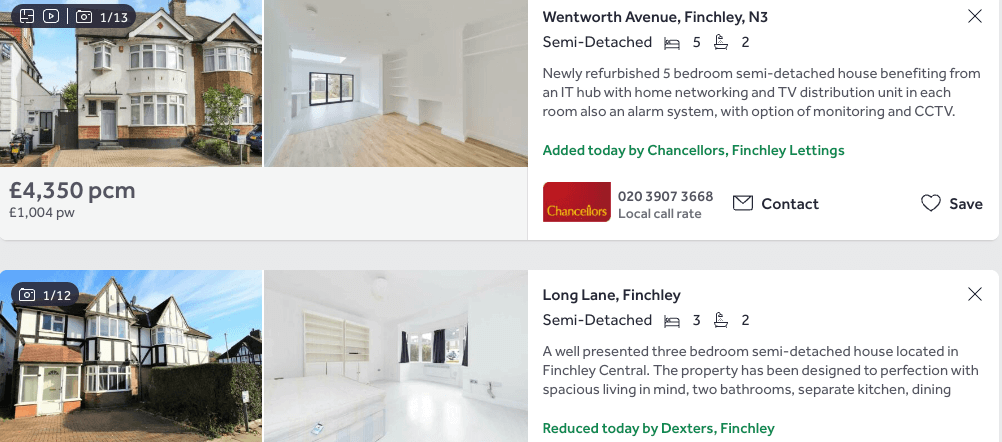

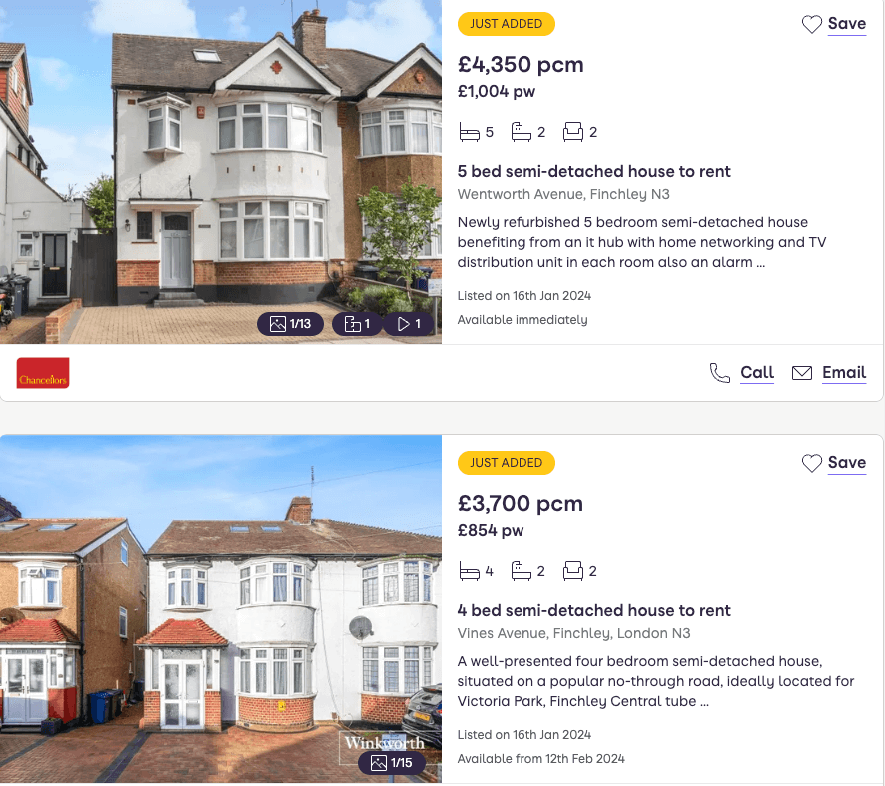

Rightmove

This app has many features that help you zero in on the right place without wading through endless unsuitable listings. You can use filters to specify what you’re looking for – perhaps a three-bedroom house with a garage or a flat just a stone’s throw from the nearest playground. It’s essential to get specific with filters to save yourself time. You can also set up email alerts so you’re the first to know when a new property that ticks all your boxes hits the market.

Available on iOS and Android

Key Features

- Comprehensive search filters

- Instant alerts for new properties

- Detailed property descriptions and photos

- Map view to check the property’s location

- School checker for local education options

Zoopla

It’s not just about the listings – you also need a heap of information that can influence your decision. With Zoopla, you can compare property prices in your desired area, helping you understand if a house is fairly priced or if you can hope for a bargain. Plus, you can dive into a property’s history, which can be incredibly enlightening. After all, you’ll want to know if the house has been on the market for a while or if it’s changed hands more times than you’ve had hot dinners.

Available on iOS and Android

Key Features

- Property price comparison tool

- Historical property data

- “Smart” property value estimates

- Area stats on local services and demographics

- “Travel time” search for commute planning

Learn here the difference between Rightmove and Zoopla

OnTheMarket

You’ll appreciate the clean design and how quickly you can get to grips with it. This app prides itself on the speed at which listings are updated, meaning you get the latest properties as soon as they’re available. OnTheMarket also works closely with estate agents, giving you the inside track on new homes before they’re widely advertised.

Available on iOS and Android

Key Features

- Fast updates on new listings

- Exclusive properties not listed on other apps

- User-friendly interface

- “Instant alert” service for new properties

- Collaboration with local estate agents for unique insights

PrimeLocation

This app is a treasure trove of high-end properties that might be what you’re after if you’re keen on something special. Their advanced search options mean you can be picky – think along the lines of specifying the number of bathrooms or looking only at homes in the best school districts. And because they know that buying a house can be as confusing as trying to assemble flat-pack furniture without instructions, there’s a whole section full of advice to help you understand everything.

Available on iOS and Android

Key features

- ‘SmartNewHomes’ section for new builds,

- Property history, which shows previous sale prices

- Travel time search to show your commute

- A map view to scout out the neighbourhood

- A wealth of resources and tips for buyers

Nested

Nested’s approach to buying and selling is unique, offering a chain-free experience that could save you from a world of stress. The agents explain the whole process clearly, which is more than welcome if you’re new to the UK property market. And if you need financial advice or services, they also have that covered.

Available on iOS and Android

Key Features

- A valuation tool to check how much your home could sell for

- An option to ‘part-exchange’ your home, making the move smoother

- A clear timeline for your sale so you know what to expect and when

- Financial service partnerships to help with mortgages and insurance

- A ‘Nested Guarantee’ that promises to sell your home within 90 days

Plazebuzz

This app is less about the bells and whistles and more about giving you a solid, user-friendly experience. It’s got all the features you need without making you feel like you’re trying to pilot a spaceship. Their filters are top-notch, so you can quickly whittle down the options to find something just right for your family’s needs. You can set up alerts, too, so you’ll be the first to know when something new that ticks all your boxes pops up. And we all know how quickly good places can get snapped up.

Available only on iOS

Key Features

- A comprehensive search across multiple property sites

- Alerts for new listings that match your criteria

- A ‘Discover’ feature to find areas that suit your lifestyle

- A ‘School Checker’ to see local schools and Ofsted ratings

- Rental and purchase price comparison to ensure you’re getting a fair deal

Additional Resources for House-Seeking Families

When you start looking for a new home, it can feel like you’re wading through a never-ending sea of options and decisions. But you’re not alone in this. There are loads of online forums and community groups where you can chat with others in the same boat. These spaces are brilliant for getting the inside scoop on neighbourhoods, schools, and even local amenities. It’s like having friends who’ve already been through it all, ready to share their experiences and advice.

If you’re a first-time buyer, the government has a few resources that can help. Initiatives like the First-Time Buyers Scheme can offer you a leg-up onto the property ladder. Check the official government website for the most up-to-date information, as it’s quite straightforward and won’t leave you scratching your head. They break down the jargon, laying out everything from stamp duty relief to equity loans.

Speaking of finances, you’ve got to get your head around the numbers, and that’s where financial planning tools and mortgage calculators come into play. Online, you can find various tools that can help you determine what you can afford to borrow and repay without needing to set foot in a bank. It’s essential to be realistic about what you can pay each month, factoring in the mortgage and all the other costs of running a home. Some of the costs include:

- Property value: The cost of the property directly impacts the loan amount you need.

- Deposit: The amount you put down upfront.

- Income: Your employment status, salary, and other income sources.

- Expenditure: To estimate your disposable income, lenders analyse your financial commitments like bills, debts, and loans.

- Employment stability: Secure employment bolsters your application, while freelance or temporary work may require stricter assessments.

- Loan term: Longer terms spread out repayments but accrue more interest. Shorter terms might require a larger monthly investment, but the long-term costs are lower.

- Interest rate: This significantly impacts your total payments. Fixed rates offer stability, while variable rates can become lower or much higher, depending on the market conditions.

- Mortgage type: Different types (e.g., fixed-rate, tracker, offset) cater to diverse needs and risk profiles.

- Bank of England Base Rate: This influences overall mortgage rates in the UK.

That is a lot to keep track of, so a little help with your maths can greatly help in the long run.

Seal The Deal

House-seeking apps can seriously simplify your search for your perfect family home in the UK. With instant alerts, detailed filters, and virtual tours, you’ve got the tools to make informed decisions without the runaround. Make sure you have the right to rent ready!

There’s no need to rush – finding a family home that ticks all your boxes is worth the patience. Sure, the choices and the paperwork can get a tad overwhelming, but when you find that spot that just feels right, the sense of relief and excitement is unbeatable. BEWARE OF SCAM!

Imagine the kids picking their bedrooms and that first family meal in your new space. So, chin up, you’ve got this! You’re not just looking for a house – you’re creating a home, and that’s something truly special.